Do you Excel?

Excel is currently the backbone of the global financial system, which I believe is a serious Governance issue. Let me elaborate.

In 2010, Harvard economists Carmen Reinhart and Kenneth Rogoff released their paper “Growth in a Time of Debt”. They argued that economic growth rate falls off a cliff once countries are expanding their national debt beyond 90% of GDP. Put in the context of the Global Financial Crisis and the resulting unprecedented public deficits, the paper provided welcome ammunition for fiscal hawks and played an important role as scientific support for austerity measures across Europe.

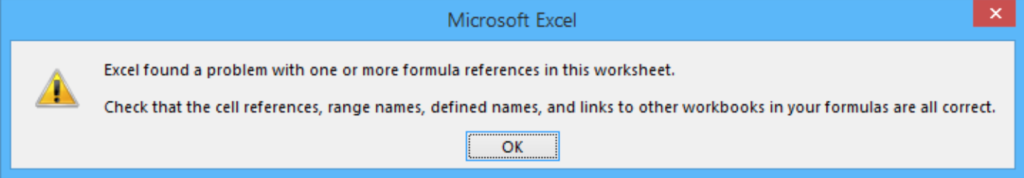

However, in 2013, researchers from the University of Massachusetts debunked many of the claims in the Reinhart–Rogoff paper by showing that their Excel spreadsheets contained a serious formula error:

“A coding error in the [Reinhart-Rogoff] working spreadsheet entirely excludes five countries, Australia, Austria, Belgium, Canada, and Denmark, from the analysis. [Reinhart-Rogoff] averaged cells in lines 30 to 44 instead of lines 30 to 49…This spreadsheet error…is responsible for a -0.3 percentage-point error in RR’s published average real GDP growth…”

John Doe Tweet

We may find it rather embarrassing that it took three years until somebody discovered such a material error in a high-stakes scientific paper, but mistakes like this are not at all uncommon.

JP Morgan lost over $6 billion in the “London Whale” trading incident, which went undiscovered due to spreadsheet errors in their Value at Risk model;

Fidelity miscalculated the net capital loss in one of their flagship US funds by $2.6 billion because of a missing minus sign in a spreadsheet;

Fannie Mae misstated their shareholder equity by $1.1 billion because of an inaccurate Excel file;

Barclays suffered large financial losses after they found out that they had bought 179 unwanted contracts in the Lehman liquidation because they had not been deleted, but only hidden in an Excel file.

A 2015 study by Hermans and Murphy-Hill investigated the Enron email archives. They found that 10% of all emails either contained or discussed Excel files and that a whopping 24% of these spreadsheets contained formula errors.

The problems with Excel are manifold:

Copying and pasting of data is error-prone and can mess with formula ranges.

Models are often poorly or not at all documented.

There is no access control and no audit trail.

Multiple versions of the same files create consistency problems.

Overwriting a single cell in a complex model can invalidate the calculation results without leaving a trace.

But still, Excel is the most widely used tool in accounting, investment and compliance departments of financial firms across the world.

What gives? Excel is easy to use, it is already installed on every computer and even the most basic users can organize information in tables and create simple calculations.

Even though the problem is well known, quite common and has potentially catastrophic outcomes, there seems to be a culture of denial in many firms. Even business-critical spreadsheets are rarely peer-reviewed or otherwise tested and oftentimes changes are neither discussed, documented nor tested, frequently leaving decision makers unaware that the model has been modified in the first place. These spreadsheets are then used as basis for strategic business decisions.

Corporate governance is supposed to create the corporate behaviour required to reach a company’s objectives. In an increasingly data-driven world, it is essential to have a consistent strategy regarding how data is compiled and processed so that it can be safely used for business decisions, accounting and reporting.

Supervisory board members should ask themselves how the data in the latest board pack was compiled. If the answer is Excel, then there is a seriously important topic for discussion at the next board meeting.

TLDR: